Realme Enters India's Financial Sector with Realme PaySa

Realme is witnessing potent growth in the smartphone segment in Bharat merely it wants to closely follow and perchance beat out Xiaomi in every other segment also. Xiaomi recently took the wraps off its personal loan platform Mi Credit in India. At present, Realme today likewise entered the country's financial sector with the launch of Realme PaySa.

Realme PaySa (stylized as Realme Payसा) is described every bit Bharat's get-go full-stack financial services platform. The service has been unveiled in partnership with Oppo's fintech arm FinShell (equally seen in the header epitome higher up) and its CEO Varun Sridhar will lead Realme PaySa efforts in the land.

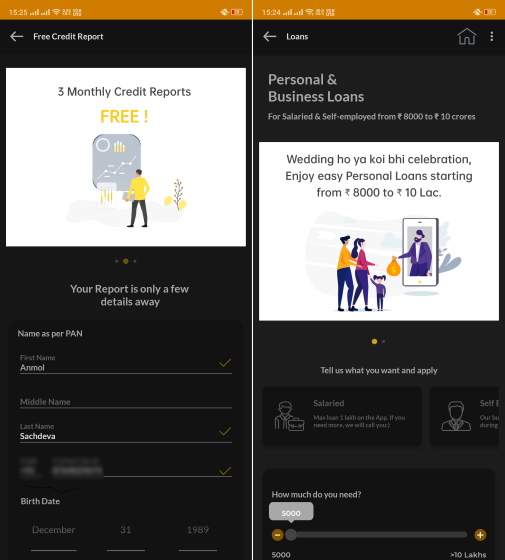

The platform pits itself directly against Mi Credit and is designed to extend loans to both individuals and SMEs (small or medium-calibration business) in Bharat. It's also offering screen insurance (for new and quondam phones in partnership with ICICI Lombard) and 3 free credit reports in partnership with CreditMantri, which pulls info from Equifax, which I certainly have to warn you about because of a widespread data leak it was involved in earlier in 2017.

Realme Bharat CEO Madhav Sheth introduced Realme PaySa by saying, "Exist it payments or investment, Realme PaySa app will provide all. Our mission is to enable our customers to leap on to the financial services platform."

Talking about loans, Realme PaySa will offer personal loans between Rs 8,000 and Rs 1 lakhs with a repayment window of up to v years. You can repay it as shortly as within v months. Businesses, on the other paw, can secure loans between Rs l,000 and Rs xx lakhs using the platform. Realme has partnered with EarlySalary and LendingKart as its loan providers.

1 of the major highlights for Realme Paysa will have to be the real-time chat feature. This conversation service isn't run by bots and you are continued to homo back up staff, with whom yous tin talk in both English or Hinglish. They will be available seven days a week, sixteen hours a mean solar day to sympathize your financial needs and help you easily secure loans.

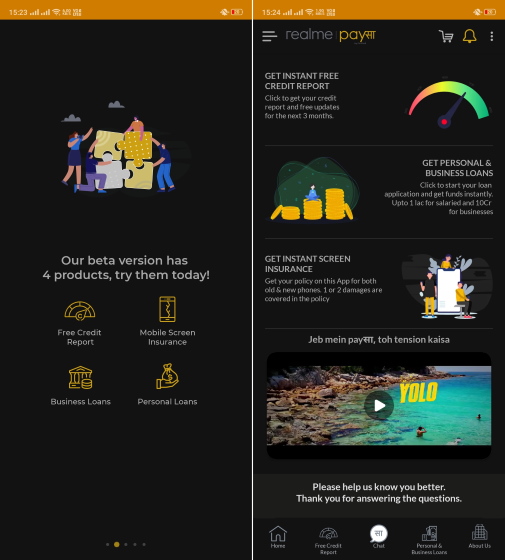

The company has launched the platform with only iv key products – free credit report, personal loans, business organization loans, and screen insurance. Just this doesn't go far full-stack, correct? Yep, Realme plans to innovate more financial services like mutual funds, digital Aureate, and SIPs (systematic investment plan), life and non-life insurance.

In addition, Sridhar on phase said that they're "studying different mobile financing tools, mobile payment tools UPI/ PPI and we will soon come with a [payment] solution." It would be similar to other payment platforms similar Mi Pay, Google Pay, and more. Realme also intends to add more financials tools for tax, budgeting and other needs.

Realme PaySa is currently in beta and the Android app is already alive for users to try out and provide feedback. It can be installed on whatsoever Android app and will be available on iOS very soon. One time the testing is complete, the app will be open to everyone and come pre-installed on Realme phones in the futurity.

Source: https://beebom.com/realme-paysa-loan-insurance-credit-report-platform-launched-india/

Posted by: snowfamere.blogspot.com

0 Response to "Realme Enters India's Financial Sector with Realme PaySa"

Post a Comment